2024 3rd QUARTER INVESTMENT BULLETIN

EXECUTIVE SUMMARY

Stock market rally continues despite a poor start to the quarter in April.

Technology and growth stocks lead the way resulting in increasing concentration.

The economy is strong, jobs growth continues, and inflation has moderated. Valuations seem stretched in large-cap growth, but reasonable in other areas.

Technology Sector Pushes Stocks Higher

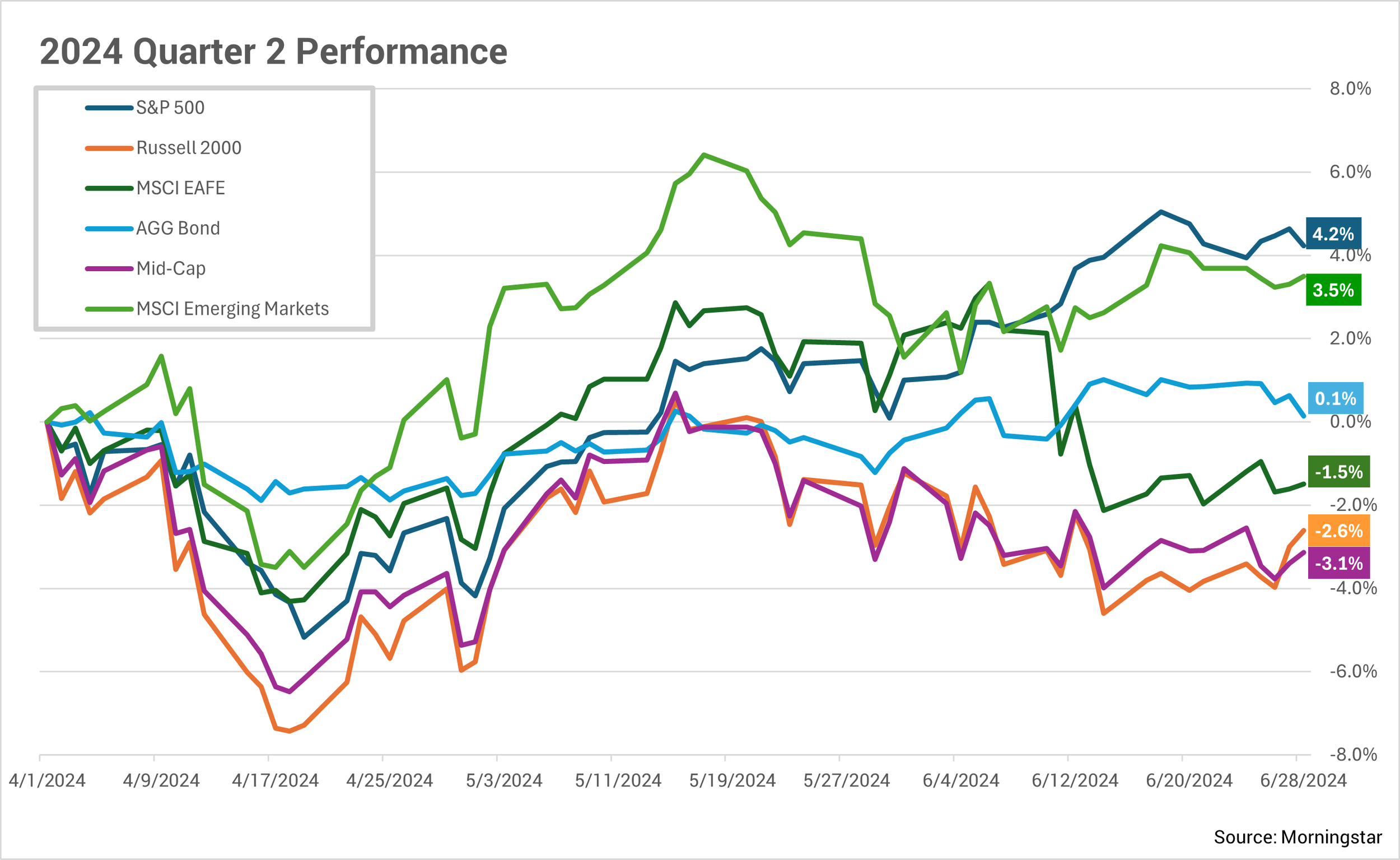

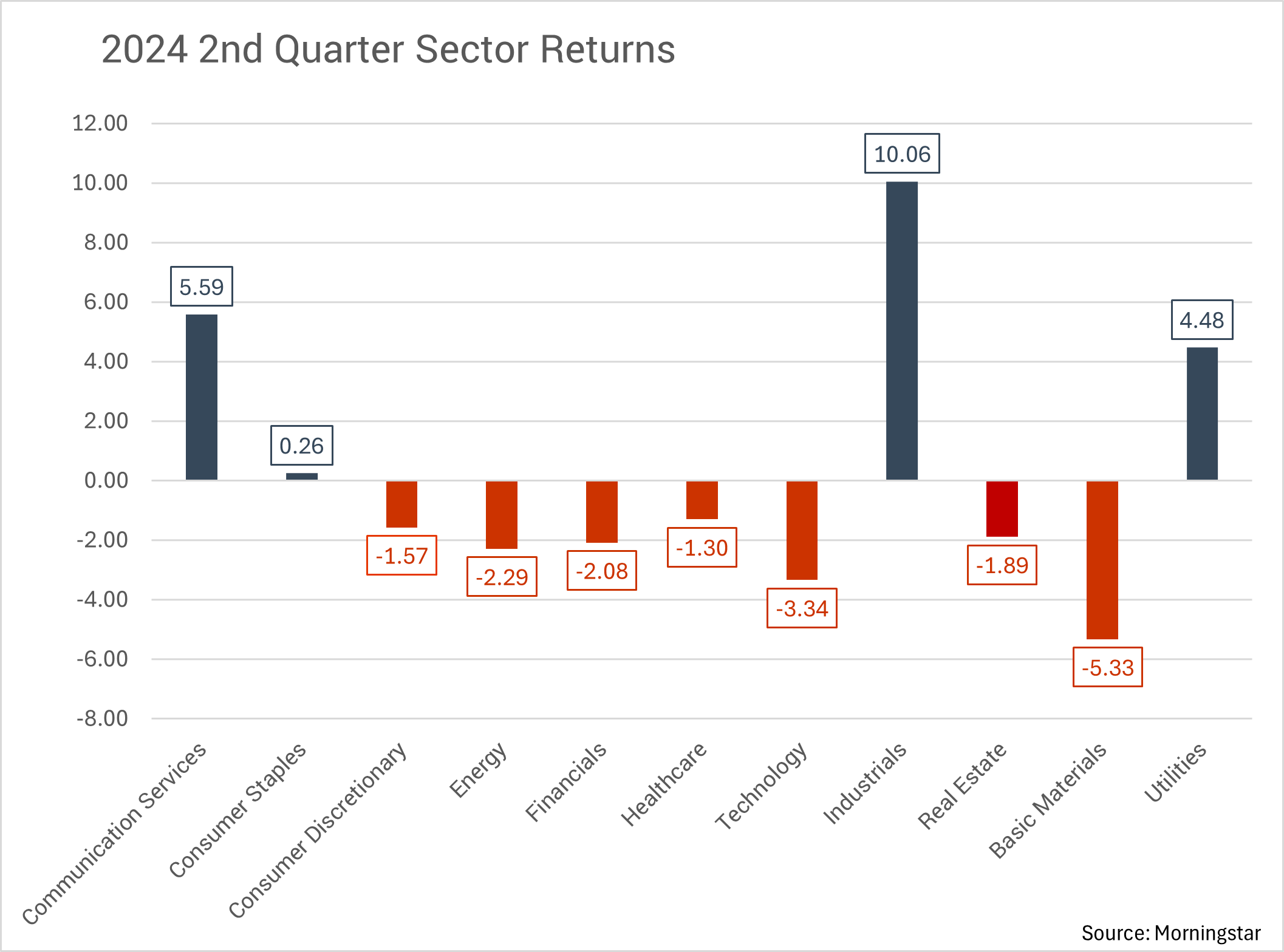

The second quarter of 2024 started out with a material decline in stocks during the month of April. The markets declined more than 4% across the board as persistently high inflation worried markets that the Federal Reserve would leave rates higher for longer. However, the slide in stocks was short-lived, and once again it has been technology stocks to the rescue. The S&P 500 increased more than 4% during the quarter powered by the technology stocks that have come to be known as the “Magnificent 7.” Those 7 stocks accounted for a whopping 61% of the increase in the S&P 500 during the quarter. You can see from the performance of various indexes below that the positive market was not widespread, but rather concentrated. The U.S. mid and small-cap indexes declined during the quarter, as did developed international stocks. Further, out of the eleven sectors that make up the S&P 500, only four sectors increased during the quarter.

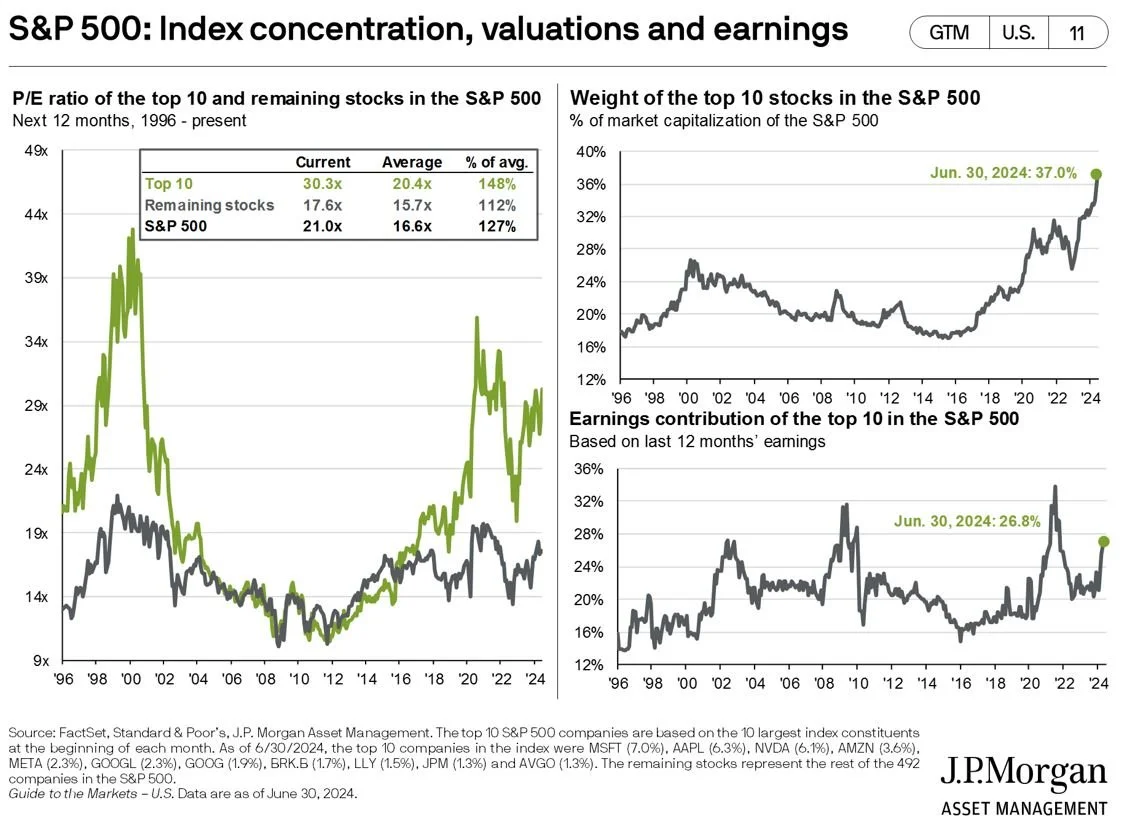

A Closer Look at Market Concentration

On the three charts that follow you can see how much the recent market gains have been driven by a small number of stocks that have done very well. In the chart on the top right, the top 10 S&P 500 stocks now make up 37% of the value of the entire index. The magnitude of concentration in only ten stocks surpasses the concentration that was realized in 2022, 2019, and 2000 when the fastest growing technology stocks suffered the greatest during the market decline in those respective years. On a positive note, the chart on the lower right-hand side highlights the earnings power of the ten largest S&P 500 stocks. The earnings of those ten stocks make up a material amount of the overall profitability of the S&P 500. While the contribution of earnings is significant, the prices of those stocks exceed their respective profitability by a wide margin.

When stock prices outpace earnings growth as they have done in those stocks, you can begin to see signs of overvaluation, which has historically meant a correction is in order. The price to earnings ratio of the top ten stocks is currently 30.3, which is far above the historical average of 20.4. Further, you can see that the current price to earnings ratio of the remaining 490 S&P 500 stocks is a much more reasonable 17.6.

These figures make it imperative that investors maintain a diversified portfolio because the likelihood of a material correction in the overvalued sections of the market becomes greater and greater as prices continue to rise.

Outlook & Positioning

The U.S. economy has been extremely strong and resilient despite higher interest rates during the last two years. The economy has consistently added jobs, and companies are generating earnings that have justified higher stock prices. A diversified stock allocation includes investments in value stocks, mid and small-cap stocks, and international stocks. All those investment categories have drastically underperformed the S&P 500 this year. It is because of that underperformance that we believe maintaining stock allocations at current levels is still justified. Even if the Magnificent 7 cools off, which seems likely by the valuation metrics, there is room to move higher if stocks that have not risen in 2024 begin to catch up to the spectacular gains of those high-flying technology stocks.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.