2024 2nd QUARTER INVESTMENT BULLETIN

Executive Summary

Stock Market Rally Continues: Market gains continued into the 1st quarter of 2024 led by U.S. Large Caps.

Rising Interest Rates: Bond yields edged higher leading to price declines muting returns.

Valuation Check Point: S&P 500 valuation is beginning to stretch beyond fair value.

Upward Trend for Stocks

The trend of robust gains in the stock market continued for the first quarter of 2024. However, unlike last year, the growth extended to sectors beyond technology as depicted in the chart below.

The bond market declined slightly as interest rates pushed higher. The increase in interest rates during the quarter is largely attributable to the diminishing prospect of sustained Fed rate cuts during 2024. It seems increasingly likely that the Fed will cut only once or twice, if at all this year.

Market Recovery Now 18 Months Old

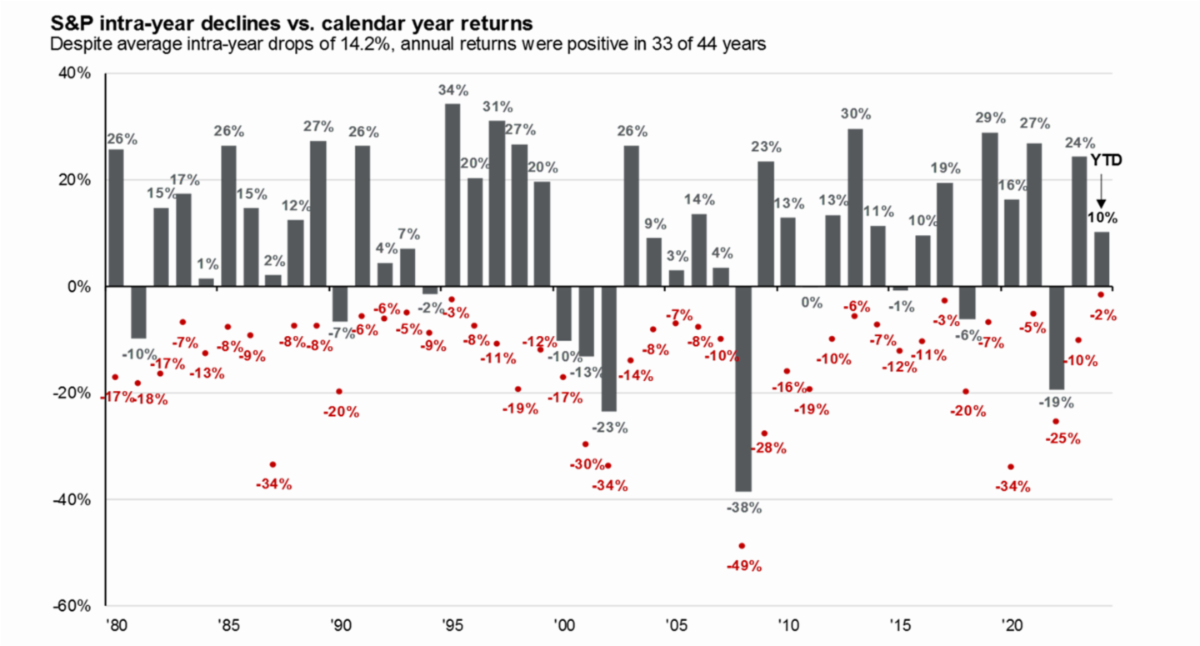

The U.S. stock market has increased 5 of the last 6 quarters dating back to October of 2022. The rally in stocks following steep losses in 2022 now shows a cumulative gain of more than 30%. The first chart below highlights how strong and persistent the quarterly gains have been. The second chart depicts the annual return of the S&P 500 and highlights the intra-year decline investors endured. It is important to note that even in positive years, the market routinely experiences downside volatility at some point during the year.

Outlook & Positioning

The strong stock gains that we’ve detailed have certainly made stocks more expensive than they were in October of 2022 when the current bull market began. The chart below shows the price of the S&P 500 (lighter blue line) and forward earnings estimates plotted together. The chart is illustrative of the beginnings of some overvaluation in the stock market as evidenced by the S&P 500. Should the gains in the stock market continue the way they did in the first three months of the year, we would anticipate some rebalancing away from stocks to mitigate risk.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.