2020 3rd Quarter Investment Bulletin

Almost as quickly as the market deteriorated during February and March of this year, we have experienced a remarkable resurgence during the second quarter. During the past few months, the S&P 500 has erased most of its losses from earlier this year. On the heels of unprecedented Federal Reserve stimulus, the markets are pricing in a return to prosperity….. or at least for technology.

V-Shaped Recovery

Per the charts below, the overall U.S. market has rebounded, mostly led by the technology sector.

Source: Bloomberg

Got Tech?

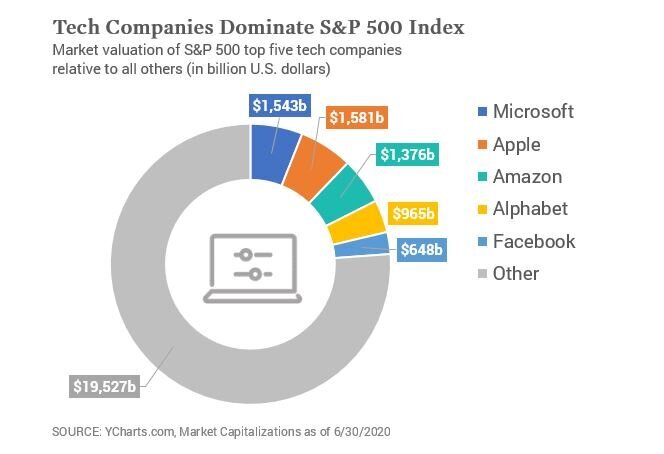

An unprecedented rally in technology stocks has created a historically high concentration in the S&P 500 and is almost single-handedly driving the overall market performance of major indices.

Some facts to consider:

Microsoft, Apple, Amazon, Google, and Facebook now account for over 23% of the S&P 500 (see chart below) and 46% of the Nasdaq.

These 5 stocks have returned 32.7% year-to-date through 6/30/2020. The other 495 stocks in the S&P collectively are still in negative territory.

The other major indices and asset classes, similarly, are showing negative returns year-to-date through 6/30/2020:

Dow Jones Industrial Average: -9.55%

Russell 2000 (Small Cap): -13.61%

International Stocks: -11.31%

Interestingly, Tesla is now 45% more valuable than Toyota with less than 1% of it’s gross revenues.

While we believe the market can continue to trend higher as we near the November elections, we have concerns about the overall health of the economy.

Where We Go From Here

Federal stimulus programs like extended unemployment benefits and the Payroll Protection Program have injected trillions of dollars into the economy to fill the void left by COVID-19. Many businesses and their employees have been significantly affected, and as the national and state-wide quarantines subside, the true impact to corporate earnings and consumer spending will likely materialize. Given this level of earnings uncertainty our portfolios are defensively postured, and we remain underweight equities in favor towards more stable assets like bonds and cash.

As always, when the boat begins to rock, we stay focused on the horizon. Fostering financial independence and managing portfolio risk is a function of time. Understanding our clients long-term goals helps our advisors create better outcomes for you, your businesses and families.