2019 2nd Quarter Investment Bulletin

The stock market during the first quarter (March 9th, 2019) marked the 10th anniversary of the current bull market run. U.S. stocks during the first three months of 2019 once again demonstrated just how resilient this bull market is. The Wilshire 5000 rocketed higher by 14% immediately following losses of a similar proportion during the last three months of 2018.

The gains were broad based with all asset classes participating in the quarterly growth. The strongest growth was in large-cap U.S. stocks, especially technology stocks. The pattern of U.S. stocks performing better than International stocks continued once again.

The chart below visually depicts the significant growth U.S. stocks have achieved during the last decade. It seems hard to believe that it’s been ten years since we were in the depths of the 2008 financial crisis. On some days that seems like a distant memory, and on others it could be yesterday. The early days of January and February of 2009, when this historic bull market run was forming, were fraught with fear and uncertainty. This chart reminds us that there were many external events during the last ten years that led to declines that at the time felt like they had the potential to derail the rise higher. The two most prominent declines occurred in 2011 and during the 4th quarter of 2018. In those two instances the losses in stocks accumulated to just shy of 20%, which by some definitions could’ve meant the end of the bull run.

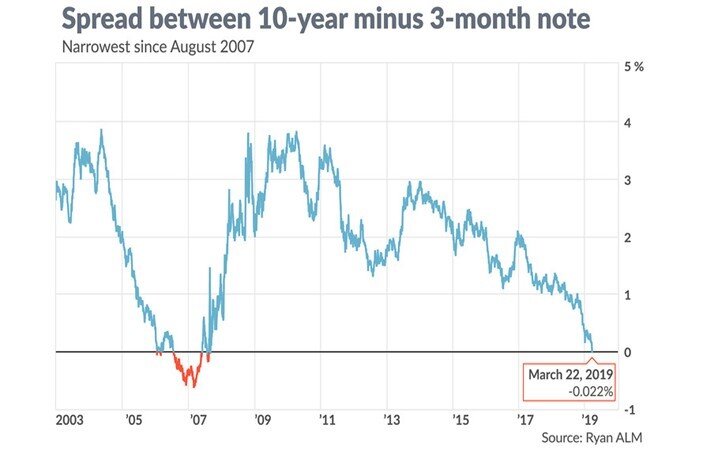

There was one additional market event that occurred during the first quarter of 2019 that hasn’t happened in more than a decade. The yield curve inverted, which is when long-term interest rates are lower than short-term rates. In mid-March the 3 month Treasury bill was paying a greater interest rate than the ten year Treasury note. Inverted yield curves generally happen when the federal reserve is increasing short term rates in an effort to stave off inflation, and at the same time market participants are buying more longer term bonds, which indicates a move to a safer investing posture.

This is significant because an inverted yield curve has been a pretty accurate predictor of a future recessionary environment. However, as the chart below shows the lead time for the beginning of a recession and the yield curve inverting has varied considerably. In several instances the recession following the yield curve inversion didn’t occur for well more than a year.

The markets are sending mixed signals, which is not uncommon at the later stages of bull markets. The last six months have been challenging for investors because of the extreme movements in stocks. We believe strongly that in this environment it is important to maintain a conservative to moderate posture and execute a disciplined re-balancing plan around these extremes. That will mean that we partially sell stocks to lower your allocation back to target following a meaningful increase in stocks, and that we incrementally increase your allocation to stocks during market declines as we did in December of 2018.